No Surprises Act Industry Altering

Legislation or Ill-Fated Attempt?

The No Surprises Act1 (NSA), a collection of three interim final rules that apply to the plan year beginning January 1, 2022, provides Federal protections against surprise billing, places limits on Out-of-Network (OON) costs and establishes new disclosure requirements for all group and individual health plans.

-

-

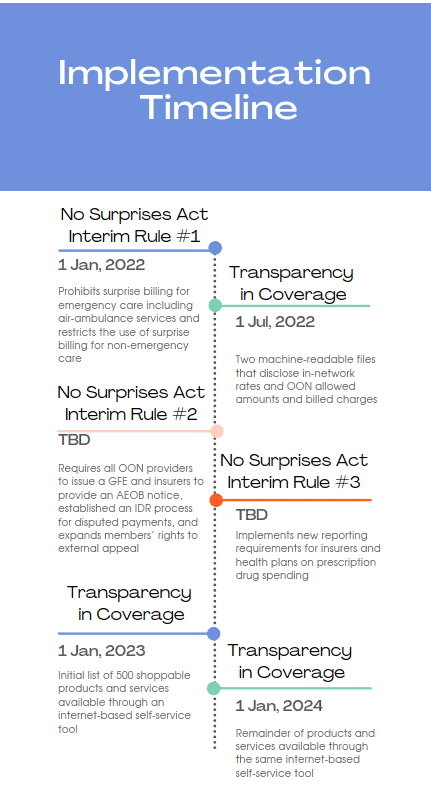

- Interim final rule #1: Prohibits surprise billing for emergency care including air-ambulance services and restricts the use of surprise billing for non-emergency care

- Interim final rule #2: Requires all OON providers to issue a Good-Faith Estimate (GFE) for goods/services, requires insurers to provide an Advanced Explanation of Benefits2 (AEOB) notice, establishes an Independent Dispute Resolution (IDR) process for disputed payments, and expands members’ rights to external appeal

- Interim final rule #3: Implements new reporting requirements for insurers and health plans on prescription drug spending

-

With the first interim final rule being based on existing state-level protections for surprise billing, there’s unlikely to be any challenges to it. The second and third however, have already encountered legal challenges and remain open for public comment. In this period while these rules are still at the interim stage, health plans can and should exercise industry leadership by submitting comments to CMS regarding aspects of the law about which they are most concerned.

NSA Legislation was passed in part because of the prevalence of medical debt throughout the U.S. In many cases, OON providers and facilities have charged exceedingly higher rates for medical products and services because they’re not subject to any regulatory cost-control measures. While health plans have honored their portion of these bills as outlined in their plan policy, it’s left members on the hook to pay the difference between the OON and in-network rates. This practice is known as balance billing and it’s the core issue the NSA is designed to address.

Navigating The No Surprises Act

Payers, health plans, providers, and other stakeholders are understandably finding the new law difficult to navigate and, with the law having met legal challenges early on many may be choosing a “wait and see” approach. It’s important to note however, that the current lawsuits all focus on the process of pricing OON claims, a single component of interim final rule # 2, and it should not stop these organizations from moving towards adoption of the other aspects of the legislation. Payers and health plans in particular should take steps to prepare their organizations and their members by investing in member education to help them navigate the complexities of the law, IT solutions to support price transparency and AEOBs, and a URAC Accredited IRO3 that has a long history in providing state and Federal external appeals.

Implementing The No Surprises Act

There’s no one-size fits all approach to how the NSA should be implemented or how it will be enforced. States that already had surprise billing legislation that meets the federal requirements of the NSA, will continue to enforce the law with Federal oversight. In all other states it will either be shared enforcement or Federal enforcement4. Since the states without previous surprise billing protections will need to make the most significant changes, it’s important to understand what the timelines for compliance might look like.

To establish a timeline let’s first look at the initial legislation that led to the development of the NSA: the Consolidated Appropriations Act, Division BB. This legislation includes Title I known as the NSA and Title II known as Transparency in Coverage (TiC). As discussed above, interim final rules 2 and 3 of the NSA are still in a notice-and-comment rulemaking period, which means enforcement will be delayed until the rules are finalized, and implementation timelines are published. The TiC law is intended to bolster the NSA with the following provisions:

-

-

- Provision #1 – Two machine-readable files that disclose in-network rates and OON allowed amounts and billed charges

- Provision #2 – Initial list of 500 shoppable products and services available through an internet-based self-service tool

- Provision #3 – Remainder of products and services available through the same internet-based self-service tool

-

CMS has already delayed the enforcement of the machine-readable files by six months5 to July 1, 2022, and there is currently an exception for a machine-readable file for prescription drugs. Provision 2 is required to be in place before the plan year beginning on January 1, 20236 with provision 3 required before the following plan year beginning on January 1, 20247. With this information we can build the following timeline:

Preparing For Change

While we can expect further modifications to interim rules 2 and 3, the broader legislative goals of the NSA will remain intact, and that means payers and health plans need to be prepared. Here are a few key steps to consider as your organization plans for the impact of the NSA:

- Review your current contracts with respect to emergency and ambulatory care to determine potential areas of concern

- Think through revenue cycle and workflow processes and document the changes that will need to be made

- Keep an eye out for updates in state and federal legislation

- Engage a URAC accredited IRO that you can rely on to provide guidance and ensure you remain in compliance

Whether you’re already relying on an IRO to meet your business objectives or plan to in the future, don’t overlook the value of a trusted, URAC accredited IRO partner like AllMed to help you navigate these regulatory challenges and reduce your operational risk.